Conventional Loan Terms and Payment Structure

They also employ stricter background checks on borrowers before approving loans. Lenders require a much higher credit score to secure a jumbo mortgage. If you take a $800,000 mortgage, this is considered a jumbo loan. These loans are provided by private lenders such as banks, credit unions, and non-bank mortgage institutions.įor instance, let’s say the conforming limit for a 2-unit home in your area is $653,550. Jumbo mortgages are commonly obtained to purchase luxury houses in high-cost locations.

#Realtor payment calculator mac

These loans surpass the financing limits followed by Freddie Mac and Fannie Mae. Virgin Islandsĭata from the FHFA website Non-Conforming Conventional LoansĪlso called jumbo mortgages, non-conforming conventional loans exceed the conforming limits set by the FHFA. Virgin Islands are also assigned high-cost conforming limits.įor a detailed list of conforming limits for 2-unit, 3-unit, and 4-unit houses, refer to this table: AreaĪlaska, Hawaii, Guam & U.S. Other states such as Guam, Alaska, Hawaii, and the U.S. These places are designated HERA high-cost areas. High-cost areas are houses in major metropolitan locations and coastal states. continental baseline loan limit applies to the following areas: Arkansas, Arizona, Alabama, Delaware, Georgia, Iowa, Illinois, Indiana, Louisiana, Maine, Michigan, Missouri, Minnesota, Mississippi, Montana, New Mexico, North Dakota, South Dakota, Vermont, Wisconsin, and majority of locations in the continental United States. This means the conforming limit for single-unit homes in high-cost areas is $970,800. As for areas where house prices are expensive, the ceiling is at 150 percent. Prescribed Conforming Limitsįor 2022, the FHFA set conforming limits for single-unit homes in the U.S. However, if you exceed the $702,000 loan limit, your mortgage will classified as a non-conforming conventional loan. If you took a mortgage at $500,000 for a 2-unit home, it is considered a conforming loan. To give you a better idea, let’s say the conforming limit for a 2-unit house in your area is $702,000. Why are conforming limits required? According to the 2008 Housing and Economic Recovery Act (HERA) conforming limits must be adjusted annually to accurately show changes in average house prices.

In general, residences situated in coastal areas and major cities have higher conforming limits. Conforming limits may be lower or higher, depending on the location of the house. This is the prescribed cap on loan amounts you can borrow for conforming loans. Conforming Conventional LoansĬonforming conventional loans adhere to conforming limits set by the Federal Housing Finance Agency ( FHFA). This is being provided for you to plan your next loan application.Conventional loans are classified into two types: conforming conventional loans and non-conforming conventional loans.

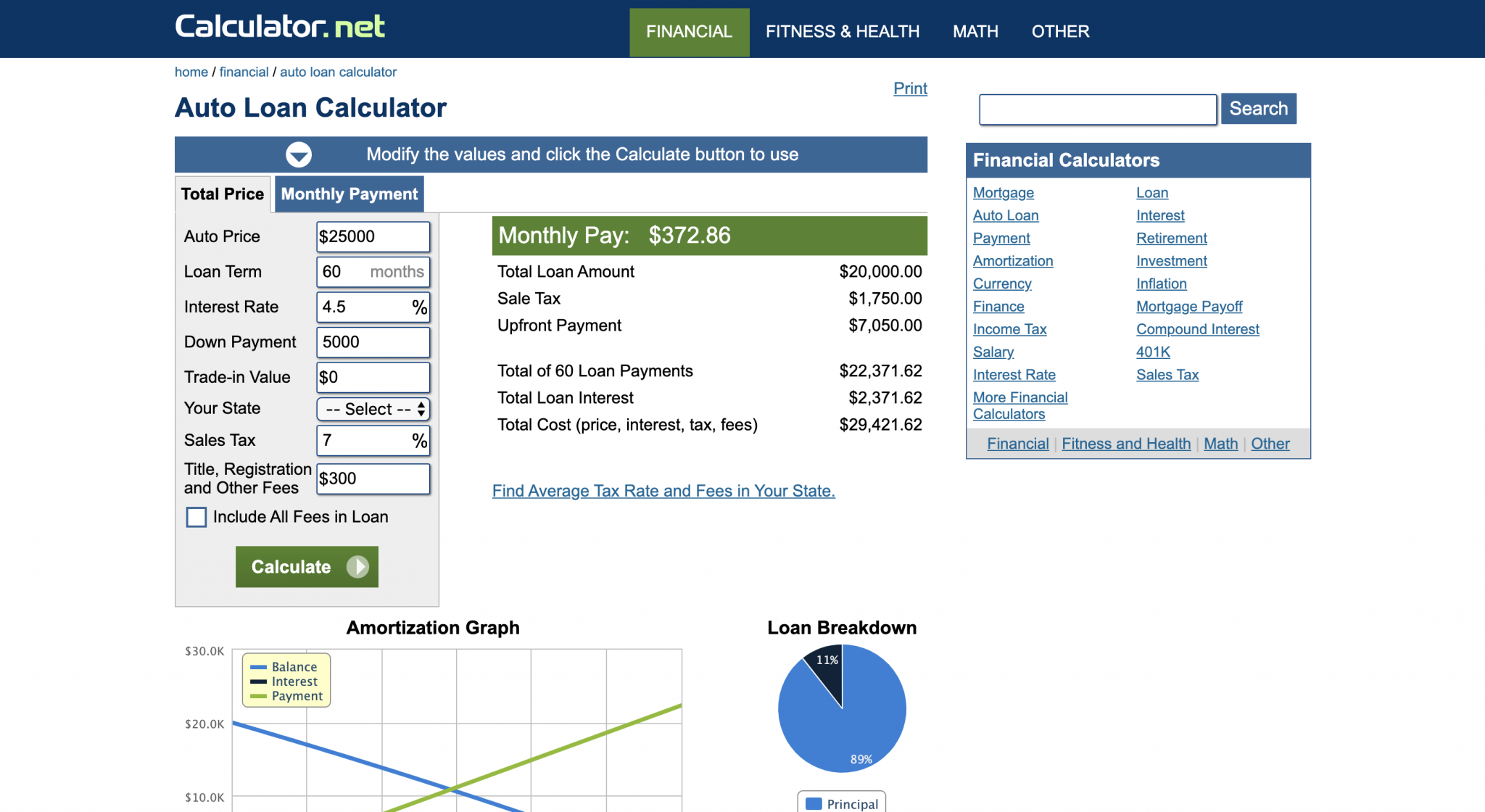

They will be a close approximation of actual loan repayments if available at the terms entered. The results of this loan payment calculator are for comparison purposes only. The results are rounded to the nearest dollar. If you want to make a new calculation, press "Reset" before entering all the information. To use this calculator, please input the value of the property you intended to purchase (mostly it is the purchase price), the length of mortgage in years, and the annual mortgage rate (please enter a rate between 2% and 20%). The payment is calculated for down payment of 5%, 10%, 15% and 20% of the purchasing prices respectively. This is a simple calculator for mortgage payment based on the purchasing price of the property, length and interest rate of the mortgage, and the amount of down payment. Understanding and Avoiding Overdraft and Nonsufficient Funds (NSF) Fees.

0 kommentar(er)

0 kommentar(er)